Augmented reality fashion overlays digital garments onto the physical body, creating new modes of style and self-expression that bridge pixels and fabric. This convergence is already reshaping how designers work, how brands sell, and how customers make choices about what to wear.

The article that follows examines current technologies and retail implementations—online and in malls—profiles pioneering brands and studios, surveys the apps that let users virtually try clothing, and outlines key trends for 2025.

The Digital Disruption: How Augmented Reality is Revolutionizing Fashion

Augmented reality fashion overlays computer-generated garments and effects onto the physical body, using body-tracking, depth sensing and real-time rendering to make digital clothes respond to movement and lighting. Unlike virtual reality, which transports users to separate environments, AR augments the existing world—so garments appear on a person in real time and in context.

The practical consequences are wide-ranging. Designers can prototype without material waste; fashion brands and retailers can offer richer shopping experiences in-store and online; and customers can evaluate fit, proportion and style before purchase, reducing uncertainty and returns.

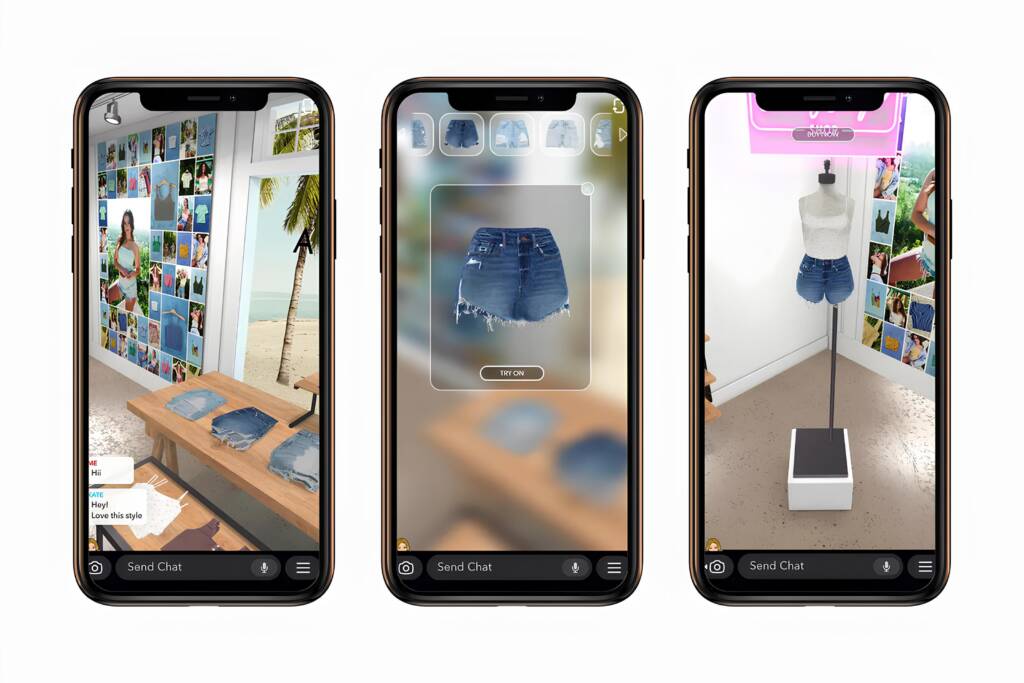

These applications already appear in malls and flagship stores as smart mirrors and AR kiosks, and on social media platforms via mobile lenses and filters. Examples include in-store virtual try-on mirrors, Snapchat and Instagram AR try-ons for accessories and footwear, and retailer integrations that let shoppers visualize products on their phone before they enter a store.

Experience the future of fashion

Step into the world of digital fashion with DressX, where you can purchase digital-only garments intended primarily for social media and virtual appearances rather than physical wear.

Current Innovations: The Cutting Edge of AR Fashion

Retail and in-store: smart mirrors and mall deployments

Retailers increasingly install smart mirrors and AR kiosks in flagship stores and shopping malls to blend the online and offline shopping experience. These systems use depth sensors and body-tracking to render garments on a shopper in real time, letting customers assess fit, proportion and movement without changing clothes.

Malls deploy AR activations to drive footfall and omnichannel sales: pop-up try-on booths, AR window displays that animate when approached, and integrated QR codes that send a curated product list to a customer’s phone. Measured KPIs typically include dwell time, conversion rate and reduction in returns.

Mobile and social: try-on lenses and platform integrations

Mobile AR lenses on social media platforms have made virtual try-ons widely accessible. Snapchat, Instagram (Spark AR) and TikTok host filters for accessories, eyewear and footwear; users can virtually try items, share looks and follow purchase links to brand storefronts.

Third-party apps and retail tools—YouCam, Sephora Virtual Artist, and a growing number of Shopify AR integrations—let shoppers visualize products on themselves at home. For brands, these media integrations translate into measurable lift in conversion and lower hesitation at the point of purchase.

Purely digital: digital-only clothing and NFT wearables

Platforms such as DressX and The Fabricant sell virtual clothing intended for social media, video calls and virtual events rather than physical wear. Digital garments enable impossible silhouettes, animated textures and interactivity that would be impractical in material form.

NFT wearables combine tokenized ownership with cross-platform utility: digital accessories and garments can be displayed, traded or worn across gaming and social environments. Luxury labels and independent studios alike use this model to create scarcity, provenance and new product lines without inventory overhead.

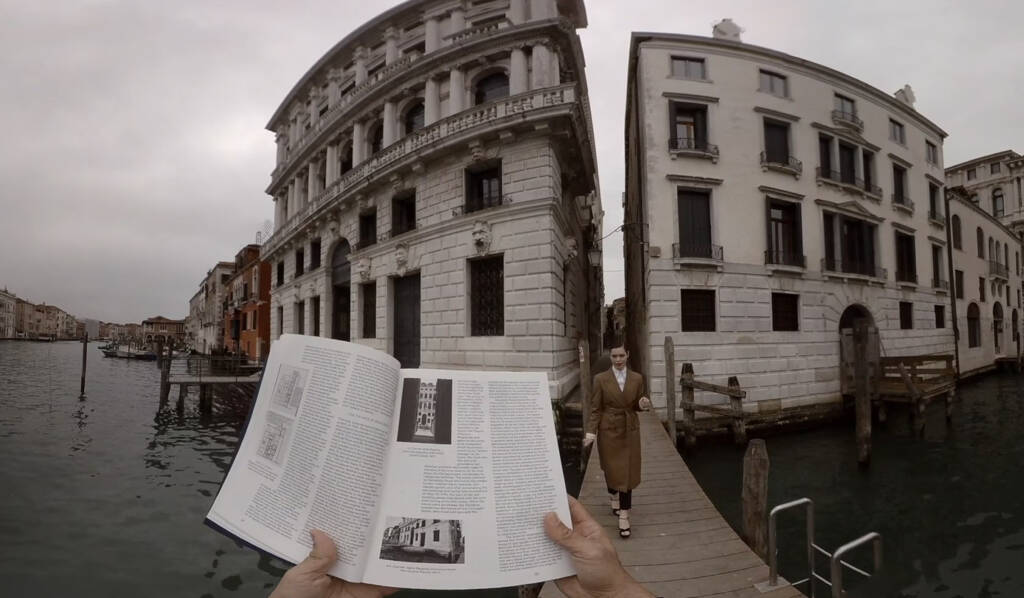

Virtual fashion shows and immersive presentations

Virtual fashion shows have moved beyond necessity into experimentation. Immersive presentations—viewable via AR-capable headsets or mobile devices—allow audiences to inspect garments from multiple angles and experience curated environments that reinforce a collection’s narrative.

Courtesy of LOUIS VUITTON

Interoperability and the platform ecosystem

Interoperability is emerging as a practical concern: brands now consider where virtual garments can be worn—social media profiles, gaming avatars or AR meeting platforms—and design with those limits in mind. Technical stacks commonly rely on Apple ARKit, Google ARCore and platform-specific SDKs to ensure consistent rendering across devices.

Measuring impact: returns, conversion and engagement

Brands measure AR initiatives by a small set of metrics: conversion lift in AR-enabled sessions, average order value on try-on journeys, dwell time at in-store kiosks and change in return rates. Early adopters report meaningful decreases in returns and higher online engagement when customers can virtually try clothing before purchase.

For retailers and malls, successful pilots typically balance the novelty of an immersive experience with practical gains—clear pathways from virtual try-on to purchase, simple in-store staff workflows, and reliable analytics to track shoppers’ behaviour.

Try virtual fashion now

Experience augmented reality fashion firsthand with Snapchat’s AR try-on features. See how the latest designer pieces look on you without leaving home; brands and retailers can pilot similar experiences in-mall to measure impact on shoppers.Launch AR Try-On

Pioneers of the Digital Runway: Brand Case Studies

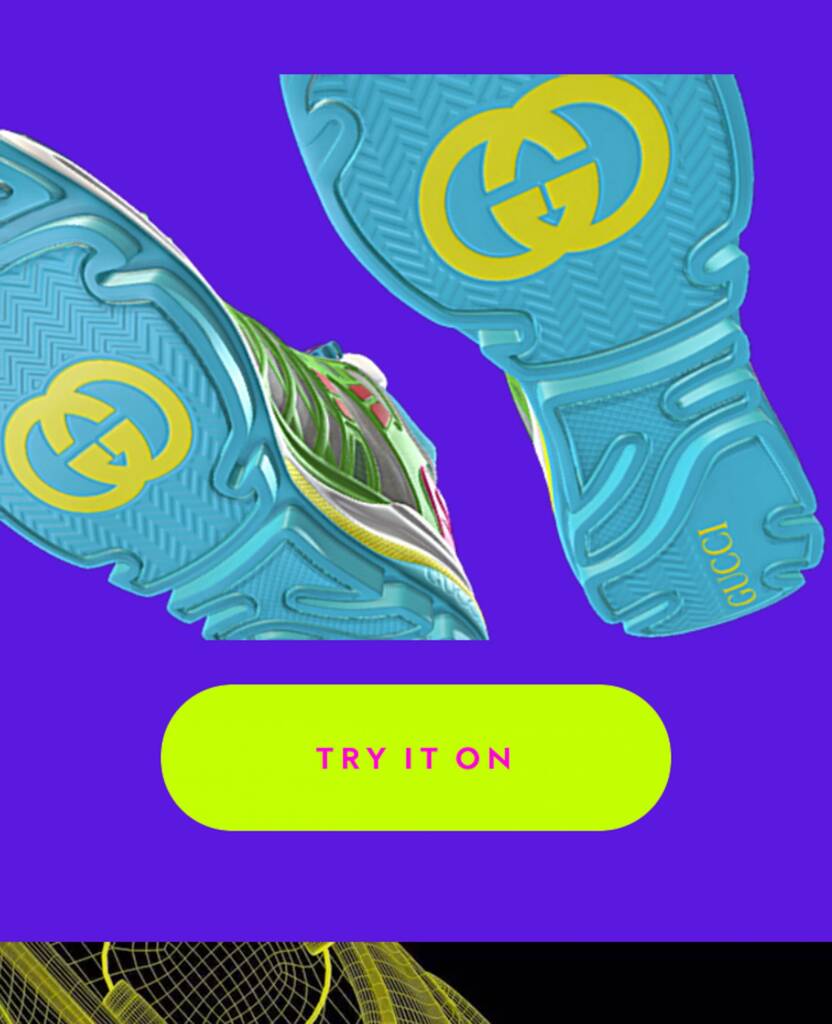

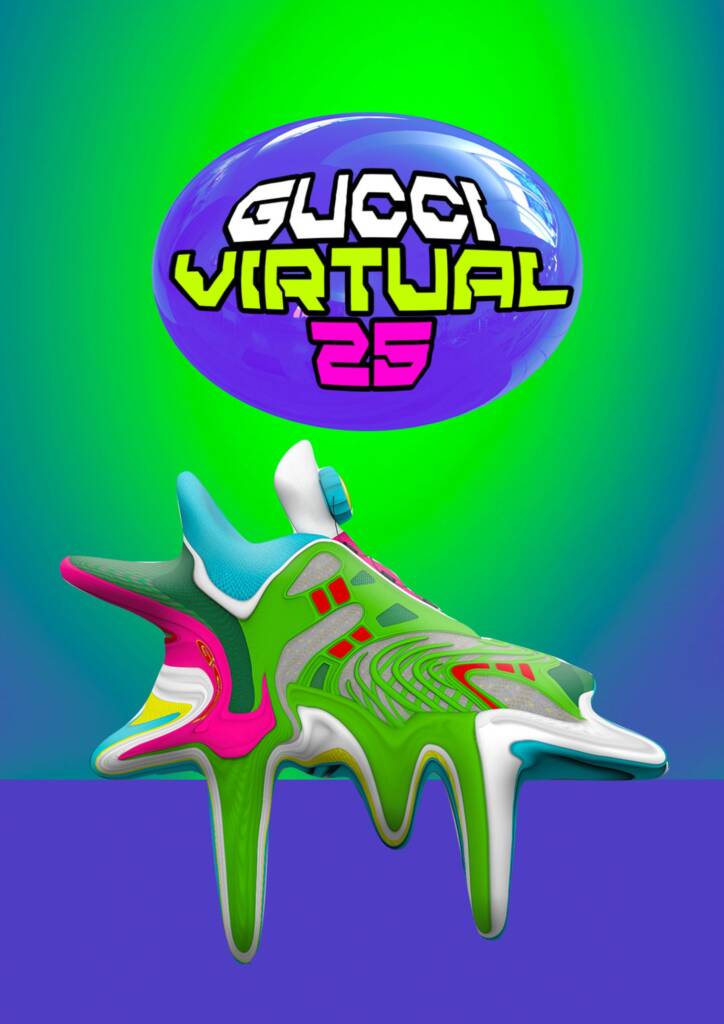

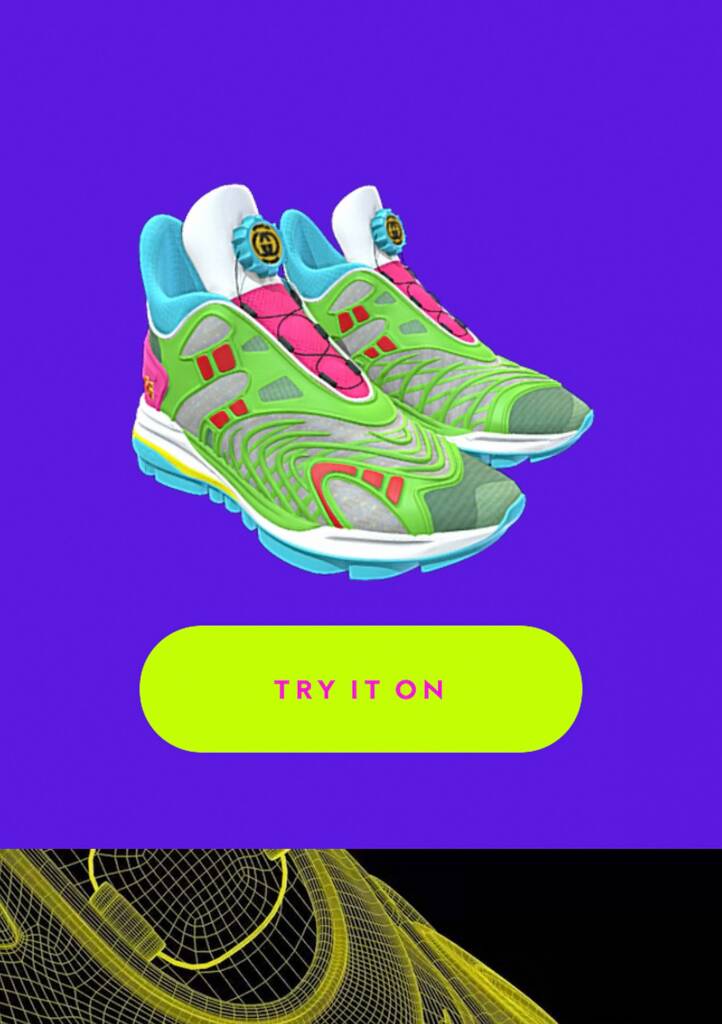

Gucci: luxury meets digital innovation

Gucci has been a prominent example of how established fashion brands deploy augmented reality and platform partnerships to reach new audiences. The brand has released digital-only items, such as limited virtual sneakers, and collaborated with gaming and social platforms to make collectible designs wearable across multiple virtual environments.

Online initiatives are complemented by AR try-on lenses on social media platforms; these let customers visualize footwear and accessories on their own images and follow direct links to buy or learn more. In parallel, Gucci has used immersive experiences—virtual gardens and curated spaces in platforms like Roblox—to increase engagement and drive traffic to both digital and physical channels.

Virtual 25 trainer

Courtesy of GUCCI

Virtual 25 trainer

Courtesy of GUCCI

Virtual 25 trainer

Courtesy of GUCCI

Balenciaga: blurring reality through digital couture

Balenciaga has treated digital channels as extensions of its creative practice, staging interactive presentations and partnering with gaming platforms to place designs inside popular virtual worlds. Their experiments range from a narrative-led video game-style show to collaborations that allow players to dress avatars in brand pieces.

These projects serve both marketing and product-testing functions: they generate earned media and user-generated content while providing data about customer tastes and virtual demand. Balenciaga’s work illustrates how a fashion brand can stitch together immersive experience, social media visibility and commerce-focused trials.

Courtesy of BALENCIAGA

Courtesy of BALENCIAGA

Courtesy of BALENCIAGA

Independent innovators: the digital ateliers

Some of the most conceptually adventurous work comes from independent studios and digital-native ateliers. The Fabricant, for example, established a business model around purely digital couture, selling tokenized garments and licensing digital assets to platforms and creators. Studios typically use tools such as Clo3D and The Fabricant Studio to design, simulate and export garments for AR and social use.

These independent creators often serve as incubators for aesthetic innovation and technical workflows: their pieces appear on social media, are resold as NFTs, or are licensed by retailers that want limited-edition virtual drops. For smaller brands and retailers, partnering with a digital atelier provides rapid access to virtual-product design without building in-house capabilities.

Offline integration: flagships, pop-ups and mall strategies

Large brands balance online reach with in-store activations: flagship stores and mall pop-ups offer AR-enabled mirrors, window displays that animate on approach, and kiosks where shoppers can scan QR codes to load virtual try-ons on their phones. These hybrid implementations are practical for malls because they increase dwell time and create direct paths from inspiration to purchase.

For retailers planning pilots, the recommended approach is modest: begin with a single AR kiosk in a high-traffic store or mall, pair it with a short social campaign on relevant media platforms, and measure conversion, dwell time and changes in return rates to determine scale-up potential.

Taking the concept fully digital, VanilleVerse—the new virtual retail space by Paris- and Los Angeles–based artist Vanille Verloës Winarick, created with IdeaSphere—pushes the boundaries of what online shopping can be. Blending gamified exploration with a minimalist, nature-inspired aesthetic, it lets visitors engage with recycled 3D-printed charms and augmented reality apparel in a world where fashion becomes both immersive and sustainable.

The Digital Divide: Challenges in AR Fashion

Sustainability: digital green or greenwashing?

Digital garments remove the raw material and manufacturing steps associated with physical clothes, which can reduce waste and the emissions tied to production and shipping. However, the servers, content-delivery networks, and, in some cases, proof-of-work blockchains that underpin virtual fashion carry their own energy and carbon costs.

Brands should report transparent metrics—energy per transaction, server locations and any offsets—so sustainability claims rest on measured accounting rather than assumption. Hybrid models that combine limited physical production with digital-first marketing can reduce surplus manufacturing while preserving craft and quality where it matters.

Accessibility: who gets to wear the digital future?

AR experiences assume a baseline of hardware and connectivity: a recent smartphone, updated OS, or in some cases, AR glasses. That creates a digital divide where the most advanced shopping experiences are available primarily to better-resourced customers and shoppers in well-served markets.

Malls and retailers can mitigate this by offering in-mall AR stations, staffed kiosks and low-bandwidth web AR that works on older devices. These touchpoints expand access and create measurable uplift in mall dwell time and cross-channel purchases when paired with clear paths to buy.

Intellectual property and ownership

When clothing becomes pixels, questions about ownership, licensing and resale take centre stage. NFT wearables introduce provenance but also new legal complexities: who owns a design when it is licensed across platforms, and how are royalties enforced when items are traded in secondary markets?

Retailers and brands should adopt clear licensing terms and consider platform partnerships that standardize metadata and interoperability. Practical steps include watermarking assets, maintaining authoritative registries and offering licensed, redeemable codes that link virtual purchases to physical benefits.

Cultural cost: what we lose when fashion dematerializes

Dematerialization offers creative freedom but risks eroding tactile traditions—the craft of cut, the feel of fabric, and the relationship between body and garment. For many customers, part of the fashion experience is sensory and social, not just visual.

The most compelling models preserve material practice alongside digital expression: limited-run physical pieces tied to digital editions, collaborative drops that reward physical purchasers with exclusive virtual assets, and marketplaces for used fashion that integrate virtual try-ons to reduce unnecessary purchases.

Practical Metrics and Remedies

Brands piloting AR should track a concise set of KPIs: conversion lift on AR-enabled sessions, change in return rates, average order value for sessions that include virtual try-ons, dwell time at in-store kiosks, and per-transaction energy metrics where available. These numbers make it possible to compare novelty against business impact and environmental cost.

Finally, accessibility, transparency and measurable outcomes should shape strategy: design AR experiences for a range of devices, publish environmental assumptions, and partner with malls and local retailers to broaden who can participate in the augmented shopping experience.

Beyond the Screen: The Future of AR Fashion

Courtesy of SHOWSTUDIO

Personalized styling: AI meets AR

The convergence of artificial intelligence and augmented reality will produce highly personalized styling: AI analyses of body measurements, past purchases and stated preferences feed AR visualizations so customers can see tailored suggestions in real time. That loop—recommendation, immediate visualization, and quick adjustment—reduces friction in the shopping experience and helps customers make informed purchases.

Companies that combine data science with styling expertise (for example, algorithmic personal-shoppers) are already piloting AR overlays; the addition of AR makes recommendations tangible rather than abstract, increasing conversion and satisfaction when deployed across social media platforms and retailer apps.

Gamified shopping: play and purchase

Gamification will continue to blur entertainment and commerce: branded games, styling challenges and avatar dress-up experiences reward engagement with exclusive digital and physical products. These mechanics extend reach on social platforms, where users share looks and retailers acquire customers through play rather than traditional advertising.

For brands, gamified elements also provide rich behavioural data—what customers try, which combinations they favour, and how virtual demand translates into physical purchase—helping product teams refine assortments and timing for drops.

Courtesy of BALENCIAGA

Courtesy of BALENCIAGA

Unified identities: bridging physical and digital expression

Consumers will increasingly maintain unified wardrobes across domains: signature elements translate from physical garments to virtual editions, while some pieces remain domain-specific. This creates opportunities for brands to sell coherent identities—digital-first capsule pieces that complement a physical collection, or digital add-ons that accompany a purchased garment.

Interoperability and clear licensing will matter: customers expect to wear a virtual item across social media profiles, gaming avatars and AR meeting platforms, so brands should design with platform ecosystems in mind and state how assets may be used and resold.

2025 trends: practical shifts to watch

In 2025 several concrete patterns are shaping the market: wider availability of AR-capable hardware (developer versions of AR glasses and richer mobile AR), mobile-first virtual try-on tools embedded in social media platforms, and AI-generated virtual garments created on demand. Expect more retailers and malls to pilot AR kiosks and in-store smart mirrors as part of omnichannel strategies.

Accessible applications to virtually try clothes in 2025 include Snap’s Try-On Lenses, Instagram and TikTok AR effects, YouCam and Sephora Virtual Artist for accessories and beauty, DressX and The Fabricant Studio for digital garments, and retailer integrations via Shopify AR and platform SDKs like Apple ARKit and Google ARCore.